The US Federal Reserve has raised interest rates to the highest level in 16 years, increasing its key interest rate by 0.25 percentage points for the 10th time in 14 months. This pushed its benchmark rate to between 5% and 5.25%, up from near zero in March 2022. However, the Fed hinted the rise may be its last one for now.

The European Central Bank also raised rates, albeit by a smaller amount than in previous months. The ECB lifted its three key interest rates by 0.25 percentage points, whereas the three preceding meetings have all seen a larger rise. Since the Fed started raising interest rates aggressively last year, prices in the US have shown signs of moderating, with inflation at 5% in March, the lowest level in nearly two years, though still uncomfortably high for the Fed, which is targeting a 2% rate.

Higher interest rates make it more expensive to buy a home, borrow to expand a business or take on other debt. By increasing those costs, officials expect demand to fall and prices to cool off. However, this has sharply raised borrowing costs in the US, spurring a slowdown in sectors such as housing and playing a role in the recent failures of three US banks.

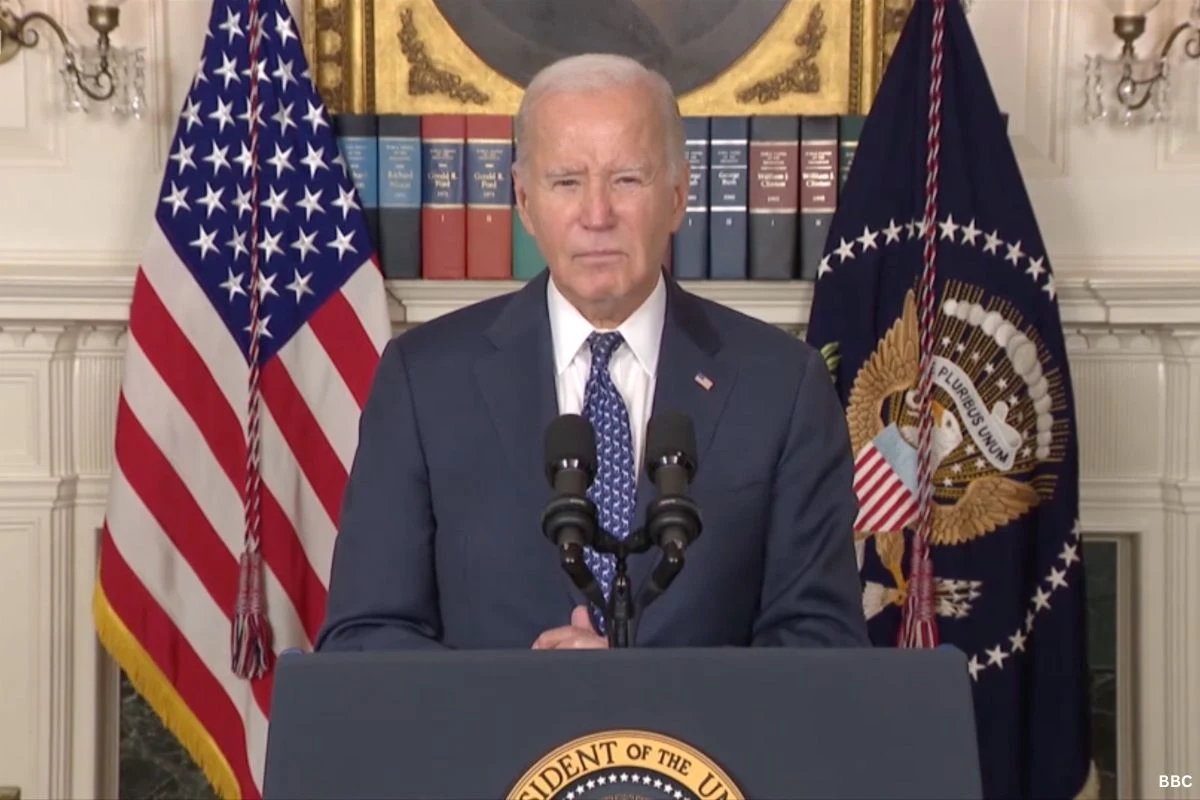

The Fed’s decision to raise rates on Wednesday was unanimous and widely expected by financial markets, which are looking for clues as to what the bank may do next. In a written statement, the bank scrapped previous guidance it provided in March when it said “some additional policy firming may be appropriate” to bring inflation under control. “We’re no longer saying that we anticipate” additional interest rate increases, Federal Reserve chair Jerome Powell said after the announcement, calling it a “significant change”. However, he refused to rule out further action, saying: “We’ll be driven by incoming data.”

Gregory Daco, chief economist at EY-Parthenon, said he thought the Fed would be “prudent” to pause now, noting that the risks to the economy as activity slows are growing. “The fear of a recession is very much present in the economy today,” he said. “I don’t think the inflation battle is over, but we are in a situation where we’re seeing gradual disinflation and we’re also in an environment where interest rates are high and elevated and therefore should be constraining business activity, which should lead to further disinflation in coming months.” Whitney Watson, global co-head of fixed income and liquidity solutions at Goldman Sachs Asset Management, said the Fed could still raise rates, depending on what happens in the coming months. “Inflation is trending in the right direction, but progress has been bumpy,” she said. “A pause in rate actions is therefore appropriate, but further tightening is plausible should inflation prove sticky.”

The recent bank failures, and an anticipated pullback in lending as a result, are likely to weigh on the economy, Mr Powell said. But he added that he remained hopeful that the US would avoid a recession, noting that hiring has remained strong and unemployment low. At Ball Chain Manufacturing, a family-owned firm in New York, customers have become more cautious in recent months due to economic worries, says president Bill Taubner. His company has also cut back on replenishing its supplies in response to still-rising prices. But he said his firm did not face imminent borrowing needs and he remained hopeful that any slowdown would be mild and relatively short-lived. “We realise there is some softness in the marketplace because of inflation and obviously the interest rate issues,” he said. “But long term, we’re very positive.”